Sustainable Indigenous Finance

Navigating the Energy Transition

The Sustainable Indigenous Finance: Navigating the Energy Transition is a first-of-its-kind resource developed in collaboration by US SIF: The Sustainable Investment Forum, First Peoples Worldwide, and ImpactARC to help investors integrate Indigenous knowledge, values, rights and priorities into investment decision-making as the world navigates the energy transition.

As global markets evolve, the intersection of Indigenous Peoples and the energy transition is becoming an increasingly material issue. Until recently, most investors lacked the frameworks, data, and tools to meaningfully assess company and investment impact on Indigenous Peoples. This investor guide equips investors to strengthen due diligence, manage material risks, uphold fiduciary duty, and unlock opportunities for shared prosperity - ultimately bridging the worlds of Indigenous sustainability and modern finance.

This investor guide highlights the importance of recognizing Indigenous Peoples as central partners in sustainable finance and lays the groundwork for the forthcoming Sustainable Indigenous Finance Hub at US SIF - a key platform within the broader Sustainable Indigenous Finance Initiative.

Inside the Guide

This guide brings together dynamic insights, data, analysis, tools, and resources to give investors a credible, well-rounded view of the key considerations related to the energy transition and Indigenous Peoples. It is designed to be a working resource for investors and others who oversee management of assets.

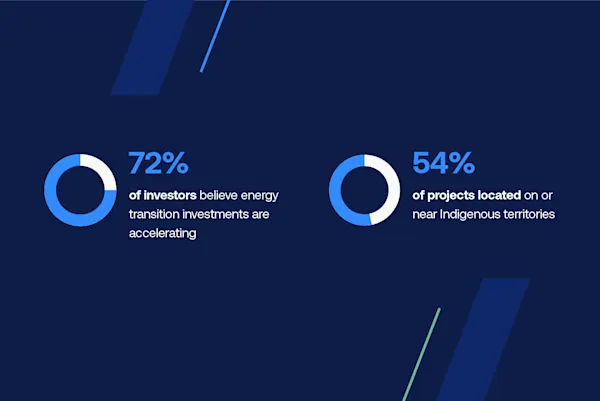

Data & Statistics

Evidence-based insights backed by the latest research, market data, and global trends.

Expert & Indigenous Voices

Insights from consultations, case studies, and contributions that ground guidance in real-world experience.

Practical Guidance

Actionable tools, frameworks, and resources to help investors make responsible, evidence-based investment decisions.

Why The Guide Matters

The energy transition increasingly intersects with Indigenous Peoples and lands, and investors face a critical inflection point: the need to move beyond traditional risk frameworks and embrace inclusive, values-driven approaches to investment.

The guide equips investors to:

Proactively manage risk:

Highlights potential legal, social, environmental, and reputational risks, helping investors avoid challenges and protect long-term value.

Uphold fiduciary duty:

Reframes Indigenous inclusion as a strategic imperative directly tied to financial materiality and performance, long-term value creation, and systemic resilience.

Unlock opportunities for shared prosperity:

Demonstrates how Indigenous engagement can generate benefits for communities, ecosystems, and portfolios alike.

A Shared Lens for Investors and Communities

"Renewable energy is critical to enabling and hastening the much-needed energy transition, benefiting us all. However, those benefits do not exempt companies from their duty to respect human rights, including the right of Indigenous Peoples to self-determination. It is vital that investors, as fiduciaries and advocates, conduct thorough due diligence on companies and projects to ensure they respect the rights of Indigenous Peoples."

Steven Heim, Managing Director, Boston Common Asset Management

Five Reasons for De-Risking Investment

Uphold Fiduciary Duty: Investor fiduciaries have a duty to consider investment risks related to inadequate recognition and integration of Indigenous Peoples’s concerns, and failure to do so may constitute a breach of this duty.

Manage Risks: Investors and companies face both hidden and visible material risks when projects fail to adequately consider Indigenous Peoples, resulting in operational, legal and compliance, reputational and brand, political and country risks.

Address Systemic Challenges: Systemic risks – such as biodiversity loss or climate change – are closely linked to negative impacts on Indigenous Peoples and may trigger cascading effects across investment portfolios. Institutional investors are increasingly looking at systems-level investing and risk management approaches as they navigate compounding and interconnected systemic threats.

Uncover Investment Opportunities: Direct and meaningful engagement with Indigenous Peoples can unlock commercial, social and environmental benefits that conventional approaches often overlook.

Uphold Diverse Societal Values and Goals: Responsible investors play a critical role in advancing societal values and upholding Indigenous Peoples’ rights.

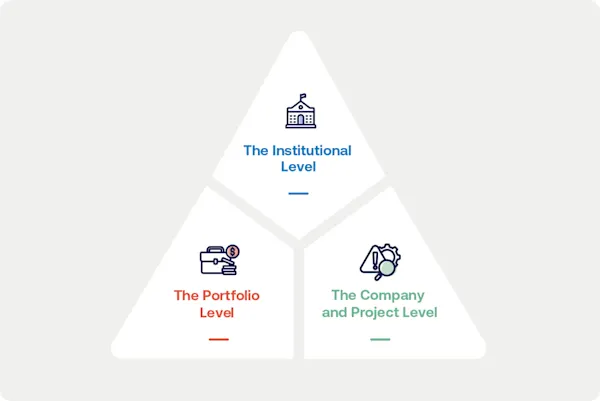

Framework for De-Risking Investments

This tool provides investors with a practical, three-tier de-risking framework that focuses on actionable steps investors can take to identify, analyze, and address related risks and opportunities.

Key Highlights:

Institutional Level: Strong governance structures and oversight, investment policies and institutional capacity help ensure effective management of risks.

Portfolio Level: High-level screening can identify companies in high-risk sectors that may require additional due diligence.

Company and Project Levels: Due diligence involves integrating potential and actual concerns of Indigenous Peoples and assessing the systemwide capacity at the company to manage risks. This evaluation determines whether the company has the competence and managerial capacity to recognize and address risks or broader systemic instability that could negatively impact Indigenous Peoples.

Sustainable Indigenous Finance Hub

Discover the Sustainable Indigenous Finance Hub. Your gateway to resources, case studies, and actionable strategies that empower Indigenous Peoples and drive meaningful, equitable change in finance.

A Note from the Collaborators

Indigenous Peoples are original stewards of many of the world’s most biodiverse and resource-rich regions, yet their rights and knowledge have been largely excluded from investment decision-making. Indigenous inclusion is more than an ethical responsibility—it is a strategic advantage that strengthens due diligence, reduces risk, and drives long-term value for investors. Developed in partnership by First Peoples Worldwide, US SIF, and ImpactARC, this guide delivers a business-focused translation of Indigenous priorities backed by data and actionable investment strategies.

Sustainable Indigenous Finance: Navigating the Energy Transition provides investors with a practical, evidence-based framework to integrate Indigenous rights into investment decisions. Indigenous Peoples steward 50% of global land, over half of the world’s remaining intact forests, and more than 40% of vital biodiversity areas and mineral reserves—making their leadership essential to a just and effective energy transition. This guide offers clear pathways to mitigate risk, unlock opportunity, and build robust, responsible investment strategies that align with both sustainable development and long-term financial performance.

Indigenous Advisory Council

Case Studies

Thacker Pass Mine Case Study

Rio Tinto Case Study

Perpetua Resources & Nez Perce Case Study

Energy Transfer Partners Case Study

Newmont and Social Impact Assessment Case Study

Teck Resources and NANA, Red Dog Mine Case Study

Storheia and Roan Wind Farms Case Study

Occidental, Talisman/Repsol and Geopark Case Study

Newmont Mining and Conga Project Case Study

Sustainable Indigenous Finance: Navigating the Energy Transition

A first-of-its-kind resource designed to equip investors with actionable tools and guidance to advance due diligence, manage material risks, and strengthen Indigenous inclusion and engagement across investment practices as the world navigates the energy transition.