US Sustainable Investment Trends and EU Corporate Sustainability Law Rollbacks

Staying the Course: Insights from US SIF Trends Report

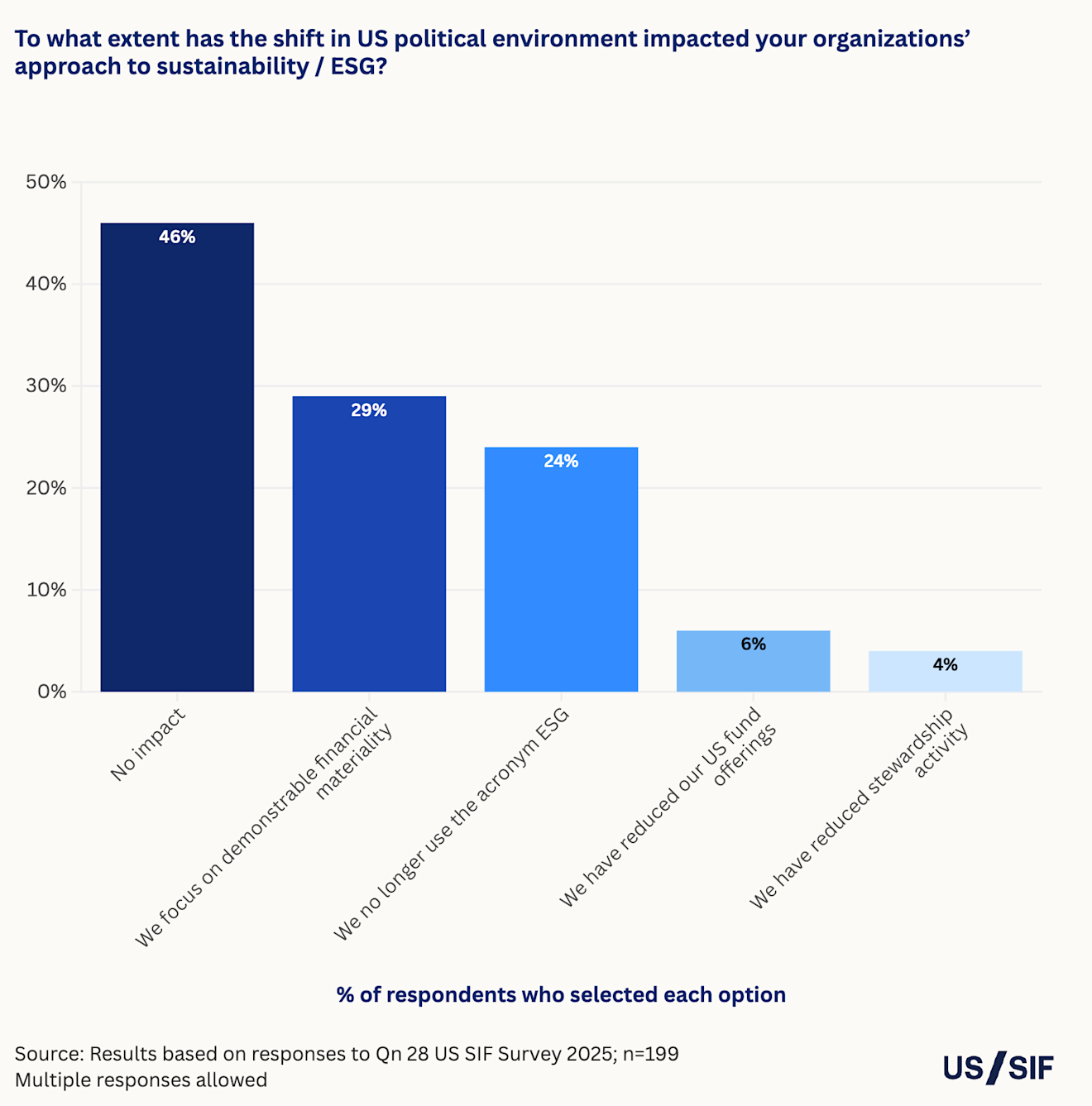

Last week, US SIF launched the 30th anniversary installment of our flagship report, US Sustainable Investing Trends 2025/26. Sustainable assets totaled 17.5% of the AUM in the United States at $6.6 trillion. Assets under stewardship totaled $42.7 trillion. 70% of survey respondents report they remain hopeful and committed to sustainability’s long-term future.

Heads down, eyes forward: Despite political headwinds, investors stayed the course. Key drivers of integrating sustainability included fiduciary duty, financially material risk and opportunity, and clients’ value-alignment. In several cases, particularly around climate and nature-related risks, respondents indicated an increased motivation to allocate capital to more sustainable strategies.

The new standard: “Client demand tells a consistent story: investors want sustainable options that align with their values and financial objectives, including 99% of Gen Z and 97% of Millennials. For them, sustainable investing is not a niche – it’s the standard. And global institutional investors continue to demand credible, data-driven approaches that price in climate risk, measure social impact, and address governance integrity,” stated Maria Lettini.

Open access: Find more insights on the Trends report, our methodology, and graphs here.

What We are Watching This Week

EU environmental rollback: The European Union reached a deal last week to weaken EU corporate sustainability laws by limiting the scope of the legislation to only the largest businesses. The Corporate Sustainability Due Diligence Directive (CSDDD) only applies to businesses with more than 5,000 employees and 1.5-billion-euro annual net turnover, and the Corporate Sustainability Reporting Directive (CSRD) only applies to companies with more than 1,000 employees and 450-million-euro annual net turnover.